Monetizing your company’s data with Neudata + AltHub

Monetizing your company’s data with Neudata and AltHub

A variety of people at a company may be asked to ‘explore data monetization’ by their leadership, including founders, CEOs, chief innovation officers and heads of data.

But without expert guidance on the market landscape, the value of your data and the most effective path to generating revenue through data sales, finding a market for your data may be tricky.

This guide aims to help those who are new to exploring the value of their data by answering questions, such as:

- What types of companies should consider exploring data sales?

- Which compliance risks related to data sales are perceived and which are real?

- How should a company monetise their data, with the goal of maximizing revenue and minimizing risk?

Roadmap to monetization

We recommend taking the following steps as a best practice for external data monetization:

Understanding the use case for your data → Productizing that data and evaluating its usefulness → Bringing that data to buyers

Evaluating data’s relevance to financial buyers

The first question stakeholders often ask when we’re discussing data monetization is: who would want to buy my data?

As an example, data buyers in the investment world – including hedge funds, proprietary trading firms and private equity firms – leverage third-party data to give themselves an edge in their investment processes.

Their use cases are diverse and can be straightforward, like using credit card transaction data to nowcast retail earnings, or more convoluted, like tracking the impact of inflation through used-car pricing movements.

As experts in this space, Neudata can help firms identify some preliminary use cases and confirm there is usefulness to your company’s data within the data buyer community.

Compliance check – can our company sell this data?

Once a company has established that their data resources hold relevance to potential buyers, the next natural question is often: would selling the company’s data be legal or compliant under existing agreements? After answering that question, most companies will review the initiative from a reputational risk standpoint.

In regards to legality, companies should review their privacy policy and existing contractual relationships. Key areas of focus are clauses establishing the rights to build analytical products with data shared and redistribute data created as a byproduct of the business, or the ownership of data provided to the company.

In terms of reputational risk and ethical concerns, it’s important to note that financial data buyers have no interest in personally identifiable information (PII) and, in fact, won’t engage with a product including any personal information. As a result, data sales to financial buyers are more straightforward than to other verticals, where PII is an important component.

Financial data buyers have no interest in personally identifiable information (PII) and, in fact, won’t engage with a product including any personal information.

Finally, companies may have concerns with regulatory frameworks. For example, an executive or compliance lead may worry the sale of data would expose material non-public information. Considerations around material non-public information (MNPI) are certainly important to consider and depend on the scope and type of data being distributed.

Taking the time to identify and understand risks is – of course – centrally important to evaluating a data sales initiative. Neudata can assist with this monitoring and can help a company understand how to mitigate those risks or concerns.

Evaluating the revenue potential for data programmes

Having established that a company’s data resources are relevant to buyers and that the associated risks are manageable for the company exploring data sales, the next natural query is to understand the size of the opportunity.

There are ultimately two levers that help gauge revenue potential:

- Total addressable market: Different buyers will be interested in data, depending on a) what type of asset it is relevant to and b) how it can be delivered (how detailed, how frequently).

For example, data illuminating cross-border trade could be of high interest to macro investors, but unless the goods being exchanged are tied to companies, the data won’t be as relevant to equity investors. Isolating the usefulness of the data across different types of users is a key exercise in understanding revenue potential.

- Pricing structure: Data pricing is incredibly wide ranging, with some data sources being sold for $2m+ per annum and others costing less than $10k per annum. The price of a data source is ideally set by analyzing a) existing market dynamics and b) the efficacy of a data product – both areas where Neudata and AltHub can provide guidance.

Proving the value – backtests and white papers

You might assume that if you have a valuable and unique data product, it will sell itself.

But data buyers in the financial services industry need proof. So, how do you go about developing a proof of concept for your data product to create a compelling sales proposition?

Backtesting: When a fund trials a data product, one of the first things it does is ‘backtest’ the data, meaning it evaluates the performance of its trading strategies by running them against historical data.

However, not all funds have the same ability to wrangle data and generate relevant insights. Data providers can therefore create a strong proof-of-concept backtest via a third party, like AltHub, to signal to the market that their data product is standardized, has sufficient history and contains alpha.

White paper: Third-party research supports marketing efforts and indicates that the data has undergone an additional level of rigor. Though many buyers will test the data using their own modeling approaches, white papers show where the information value is located and how much it correlates with benchmarks.

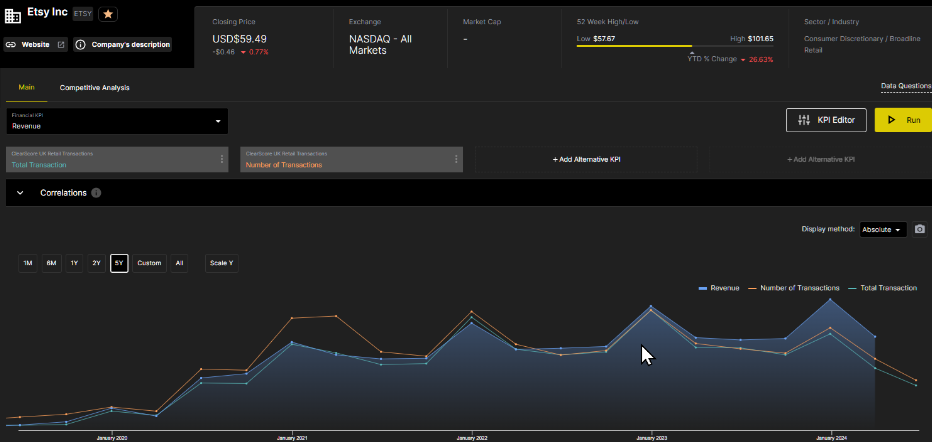

Data visualization against financial KPIs (including stock price, quarterly revenue, etc.): When selling data to investors that analyze companies in detail (fundamental investors), it is important to show how the data aligns with key KPIs. These investors often create sophisticated models based on various KPIs per firm, customized by industry.

To present data efficiently to this type of investor, a data visualization layer is important. Below is a KPI example screen from the AltHub platform which can be licensed to show your data to these types of funds.

Bringing the product to market

Now that your product has been defined, productised and preliminarily tested, only a few steps remain before bringing it to market.

Neudata and AltHub can help data owners:

- Produce contracts, terms and policies to allow potential buyers to trial and license the data

- Create sales materials, like product pitch decks

- Provide training to sales teams on how to engage data procurement professionals in the highly regulated financial services industry

Next steps

Some companies with data products may be ready to talk to buyers already, but more commonly, companies need to take some time to explore the opportunity before leaping forward.

If you want expert advice tailored for where you are in your data journey, reach out to consulting@neudata.com with more information about your company’s data.