Present Your Data to Fundamental Investors

Fundamental investors face the challenge of integrating alt data insights into their investment strategies. Fundamental Edge is designed to help data providers better present and deliver to these buyers.

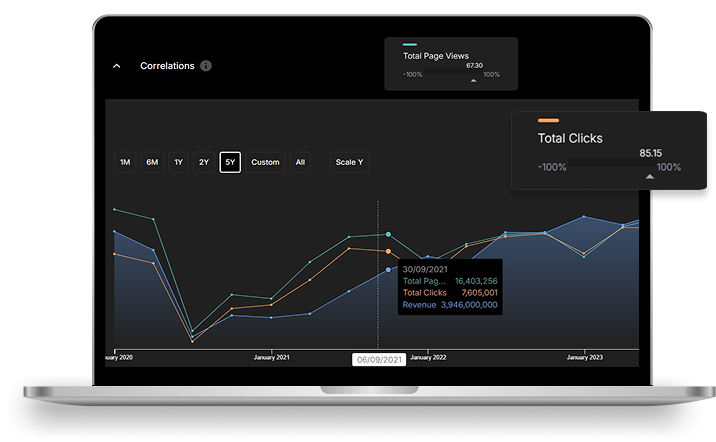

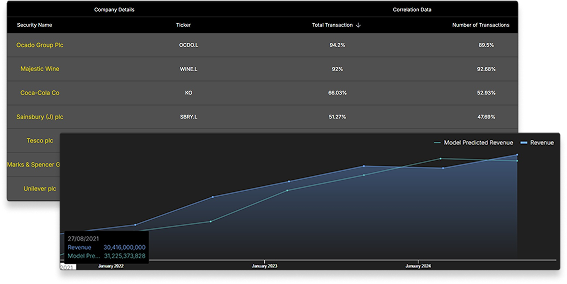

Fundamental Edge’s visuals help you illustrate clear and actionable insights to fundamental investors.